Normative, strategic, operational - the three decision-making levels for a successful sustainability transformation

The man from Brooklyn was never at a loss for words: “The social responsibility of a company is to maximize its profits.” This is how the U.S. economist and Nobel Prize winner Milton Friedman summed up the essence of “shareholder value” maximization more than 50 years ago.[1] And since then, almost everyone has adopted it – for decades. Today, this view seems antiquated and is being criticized again and again, even by the traditional business elite. After all, the shareholder value doctrine is no longer sustainable because it ignores the socio-ecological problems of our time. Sustainable business must be ecologically safe, socially just, and profitable. All at the same time.

Stakeholder value replaces shareholder value. But a paradigm shift hasn’t happened yet

In 2019, the Business Roundtable (BRT), an association of roughly 200 leading multinational U.S. companies, issued a statement in which all CEOs distanced themselves from Friedman’s exclusive focus on shareholders. According to their statement[2] , the goal of a company is rather to create long-term value for all stakeholders, from employees and suppliers to the local communities in which they operate. This implies a more long-term and multi-layered horizon for companies. CEOs accept that in the short term there may be conflicts between the interests of shareholders and other stakeholders. In the long term, however, taking into account the interests of other stakeholders is also in the interests of the shareholders.[3] Clearly, this was not a genuine paradigm shift. After all, the interests of employees, suppliers and other stakeholders are taken into account primarily when it pays off monetarily – at least in the long term – for the shareholders. The fact that this newly balanced “stakeholder value” orientation actually benefits shareholders is regularly underscored by reference to the positive correlation between ESG[4]performance, i.e. the social-ecological performance of a company, and stock price performance.[5]

Best in future instead of best in class

But even if the stakeholder value orientation reflects the spirit of the time and is applauded from many sides, it still remains wrong. At the very least, this focus is insufficient for companies that want to be guided by non-negotiable ethical-social norms and operate profitably within planetary boundaries. The main weakness of the orientation propagated by the BRT is its relative orientation, which is without absolute targets. Almost all ESG ratings and rankings have the same shortcoming: Leading companies may be “better” than competitors and perhaps even “best in class,” but it still tells us nothing about whether they are also doing the right thing in terms of what is ecologically and socially necessary today. They are simply “better” than other companies. Nothing more. A top position in these rankings does not reflect whether they are helping to preserve the planet with their business activities.

Absolute targets instead of relative targets. And a science-based transformation pathway

The assessments lack what we uncompromisingly and urgently need for the sustainable transformation ahead of us: absolute (not relative) targets, as well as transformation pathways to achieve those targets. Defined targets can be derived from a scientific understanding of planetary boundaries, which in turn can be used to calculate corresponding resource budgets and transition paths for companies, sectors of industry, and countries. Look at CO2for example: According to the Intergovernmental Panel on Climate Change (IPCC), there is currently a global residual budget of 420 gigatons of CO2[6]until the 1.5-degree tipping point is reached and climate change would still be manageable. At our current emissions level, this budget would be depleted in ten years. So what is needed? Based on this residual budget, it can be determined how much CO2 may still be emitted by which stakeholders and by when, and when climate neutrality must be achieved. Analogous targets and paths can also be defined for all other planetary boundaries – from fresh water to biodiversity. And these absolute science-based targets and pathways must be managed in the future. This is not only true for ecological factors. The target for a socially just sustainability transformation is determined by non-negotiable, ethical norms such as human rights.

Why compliance with legal norms is not enough

This approach, anchored in absolute targets and transition paths, is still new and challenging for companies. Even adopting a long-term approach and broadening perspectives to include other stakeholder groups – by focusing on stakeholder value – is a challenge for listed stock corporations. After all, the annual result must be their main priority and financial progress has to be reported every three months.

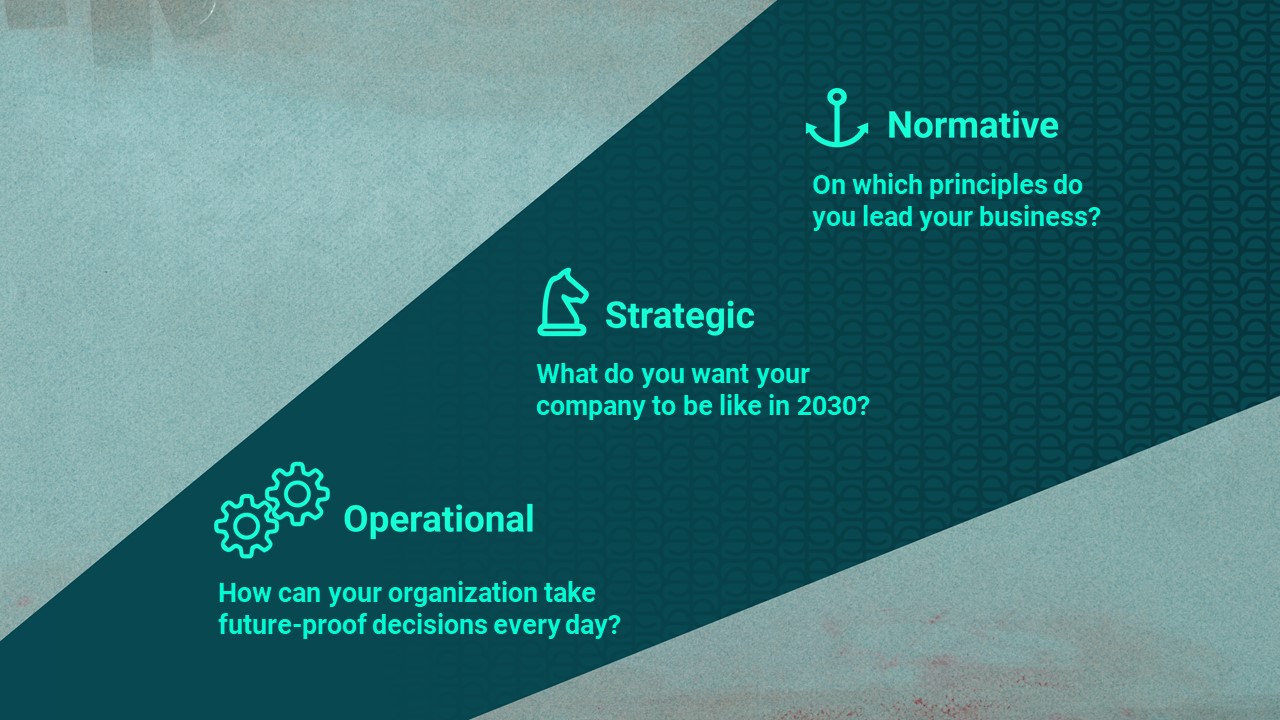

A holistic paradigm shift happens by focusing on three levels of decision-making

If entrepreneurs really want to operate effectively within planetary boundaries and respect the needs of all, they will therefore need to regularly go beyond current and anticipated legislation. In the case of climate targets, this is already happening to some extent. More than 1,000 companies have voluntarily committed to science-based climate targets, already going beyond existing law[7]. But for any business that takes all planetary boundaries and the universality of human rights worldwide seriously, it is about a holistic view, not just sub-categories like the climate. This requires a paradigm shift and fundamentally different choices – on a normative, strategic, and operational level.

Integrate Impact First entrepreneurship as a normative stance

Every company undergoes a groundbreaking realignment at the beginning. This is fundamental decision based on normative principles. The tricky question that everyone has to face is: Is this primarily about maximizing value creation for shareholders in the short or long term, or do planetary boundaries and ethical norms provide primary orientation? No one can avoid answering these questions. If your emphasis lies in the latter, the question of how to operate profitably within limits and norms must of course be answered. But only as a second step.

We refer to this normative approach as Impact First entrepreneurship. This may be unfamiliar and uncomfortable territory for some, and many consider it totally alien. Nevertheless, it offers invaluable advantages:

- Impact First companies develop a fact-based understanding of their impact on all relevant aspects of nature, from climate to freshwater and biodiversity.

- Impact First companies derive specific targets based on scientifically substantiated findings and budgets, and this provides a transition path that is in harmony with planetary boundaries. A path is laid, from the current harmful impact to a regenerative company – one that not only stops doing harm to the environment, but actually supports regeneration.

- Impact First companies establish their own understanding of immutable ethical norms and values, from basic human rights through fair pay to a trust-based and prosocial view of humanity.

As a result, Impact First companies act prudently and with foresight, and are no longer driven by the next purely financial quarterly report, public opinion, or anticipated legislation. Companies are thus relieved of enormous pressure, work becomes more pleasant, perhaps even “fun,” but certainly more meaningful. At the same time, proof of the company’s future viability can be provided, i.e. that profitable economic activity in line with planetary boundaries and ethical standards is already possible today, based on relevant and credible transition paths.

A crucial aspect of this new attitude is a small but radical paradigm shift. Profit maximization at any price? No way! Profit generation? Absolutely!

How to translate a normative stance into strategic and operational decision-making

Once this normative decision has been established as a new direction for the company, the second step is to translate this move into the following strategic alignment decisions, which come hand in hand with the following key questions:

- Who are you owned by, and what is your financial structure? What expectations do shareholders and investors have regarding short- and long-term profit distribution?

- What is the ideal outcome for the company and how are relevant socio-ecological priorities translated into long-term goals, milestones, and transition paths?

- What will constitute an attractive business model in the future, how will the company innovate, but also how will the current product and service portfolio be transformed and how will the value chain and partner ecosystem develop?

For this strategic orientation to finally take effect in day-to-day business, corresponding operational decisions are necessary as a basis for everyday work and decisions. This affects the following:

- Non-financial metrics (i.e. KPIs[8]]) and decision-making rules so that socio-ecological, long-term goals and transition pathways can be incorporated in operational decisions.

- Governance and organizational structures, as well as competencies for a supportive environment for long term transformation.

- How technology will be used to provide data and enable new forms of collaboration and cooperation.

- Practical assistance in particularly relevant specialist functions, for example purchasing (to assess sourcing alternatives), or production (to assess investment projects).

Profitable growth respecting planet and people

Friedman’s dogma and decades of traditional corporate sustainability efforts have brought us to where we are today. On the plus side, this has brought unprecedented prosperity to many people, but on the negative side, important ecosystems are now close to collapsing (or the balance has already tipped), and the human rights of billions of people are violated every day.

One thing that can be said with certainty is that leaders that adopt a normative approach – and thus decide to respect planetary boundaries and ethical norms – are not deciding to abandon profitable growth. They are simply shifting priorities. Today, profit maximization can no longer justify disregarding fundamental human rights or destroying nature. Rather, generating profits can be based on the premise that it still possible to respect people and nature. This is how we join forces in building the economy of the future. And this is good for everyone. What could be more pleasing for the planet?! Let’s get started!

Katharina Beck and Philipp Buddemeier

The authors developed their concept – three levels of decision-making for sustainable business – based on 30 years of experience, not only in the field of sustainability, but also in consulting for global management consultancies and pioneers. Their concept forms the basis of a joint book scheduled to be published in the fall of 2022. In their book, they will also present their transformation path and offer many examples of pioneers.

[1] Milton Friedman, A Friedman Doctrine – The Social Responsibility of Business is to increase its profits, 1970, Link (last accessed on 20.09.2021)

[2] Business Round Table, Statement on the Purpose of a Corporation, 2021, Link (last accessed on 20.09.2021)

[3] Business Round Table, Business Round Table Statement On The Purpose Of A Corporation – Two Year Anniversary, 2021, Link (last accessed on 20.09.2021)

[4]ESG = Environmental, Social, Governance. Financial actors use this acronym used to refer to sustainable economic activity

[5] Gordon L. Clark, Andreas Feiner, Michael Viehs, From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance, 2015, Link (last accessed on 20.09.2021)

[6] Intergovernmental Panel On Climate Change (IPCC), Social Report: Global Warming of 1.5° – Mitigation pathways compatible with 1.5° in the context of sustainable development, 2021, Link (last accessed on 20.09.2021)

[7] Science Based Targets Network, Science Based Targets – How it works, 2021, Link (last accessed on 20.09.2021)

[8] KPIs = Key Performance Indicators. Indicators by which a company is measured and controlled